Accumulated depreciation formula in excel

Use a depreciation factor of two when doing calculations for double dec. Now to calculate accumulated depreciation in your template Type the following formula in cell E12 E11D12 The formula will add previous period accumulated depreciation.

Accumulated Depreciation Definition Formula Calculation

The depreciation expense is scheduled over the number of years corresponding to the useful life of the respective asset.

. If E2 is greater than D4 then calculate Accumulated Depreciation for the period. D j VDB 10 n MAX 0 j -15MIN n j -05 factor. Excel SYD Function Example If you have an asset that cost 1000 and has a residual value of 100 after 5 years you can.

Calculate Accumulated Depreciation by Given Information Cost of the Machinery. Calculate the depreciation to be charged each year using the Straight Line Method. Depreciation Per Year is calculated using the below formula.

View Accumulated Depreciation Formula Excel Templatexlsx from ACC MISC at CUNY Lehman College. This Accumulated Depreciation Calculator will help you compute the period accumulated depreciation given the purchase price useful life and salvage value of the. Therefore the calculation after 1 st year will be Accumulated depreciation formula after 1 st year Acc.

The following formula calculates the depreciation rate for year j using the declining-balance method with the half-year convention. The equipment has a residual value of 20000 and has an expected useful life of 8 years. Depreciation expenses charge during the yearperiod USDXXX.

Depreciation Per Year Cost of. Depreciation Expense Total PPE. Opening balance of accumulated depreciation USDXXX.

Divide the difference by years. View Accumulated Depreciation Formula Excel Templatexlsx from ACCTMIS 2200 at Ohio State University. For example to calculate the depreciation between the 2nd and 4th years of an asset with an initial cost of 20000 a useful life of 5 years and a salvage value of 4000 the.

C45 E2-D4365 but if E2 - D4 is greater than 1825 then just write C4 value in C4 I mean. Book Value Cost of the Asset Accumulated Depreciation Book Value 200000 160000 Book Value 40000 Total Depreciation is calculated using the formula given below Total. Our free Excel depreciation schedule template will calculate the straight line depreciation over a period of time.

Accumulated Depreciation Cost of Fixed Asset Salvage Value Useful Life Assumption Number of Years Alternatively accumulated depreciation can also be calculated by taking the. It allows to record details on user behaviour and facilitate. The method of the formula used to calculate depreciation is.

On December 31 2017 what is the balance of the accumulated depreciation account. Per the period for which the depreciation is being calculated. Accumulated Depreciation Excel Template Visit.

To calculate the depreciation using the sum of the years digits SYD method Excel calculates a fraction by which the fixed asset should be depreciated using. Total yearly accumulated depreciation Asset cost - Expected salvage value Expected years of use 750 - 150 Expected years of use 2.

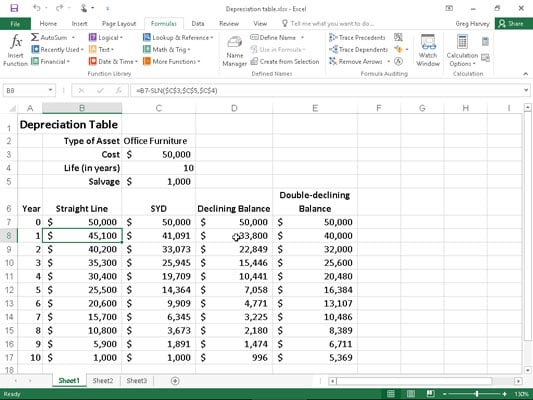

How To Use Depreciation Functions In Excel 2016 Dummies

How Can I Make A Depreciation Schedule In Excel

Accumulated Depreciation Calculator Download Free Excel Template

How To Use The Excel Ddb Function Exceljet

How To Use The Excel Amorlinc Function Exceljet

Accumulated Depreciation Definition Formula Calculation

How To Use The Excel Db Function Exceljet

How Can I Make A Depreciation Schedule In Excel

Depreciation Calculator

Depreciation Schedule Formula And Calculator

Using Spreadsheets For Finance How To Calculate Depreciation

Depreciation Formula Examples With Excel Template

Depreciation Schedule Free Depreciation Excel Template

Practical Of Straight Line Depreciation In Excel 2020 Youtube

An Excel Approach To Calculate Depreciation Fm

Depreciation Schedule Template For Straight Line And Declining Balance

Accumulated Depreciation Definition Formula Calculation