Marginal tax rate calculator

Remember however that these are marginal tax rates. Calculator disclaimers and assumptions can be found under each calculator.

Excel Formula Income Tax Bracket Calculation Exceljet

Print Income Tax Forms.

. Only half of the capital gain from any sale will be taxed based on the marginal tax rate which differs between each province. Big update for 2015. 55000 first marginal tax bracket 050 marginal tax rate 275 land transfer tax 250000 upper marginal tax bracket - 55000 lower marginal tax bracket 10 marginal tax rate 1950 land transfer tax 300000 upper marginal tax bracket - 250000 lower marginal tax bracket 15.

Small company rate and main rate are now unified at 20 percent. Gasoline purchases are not subject to the New Jersey Sales Tax but a Gasoline Excise Tax does apply. Refer to these for more information.

Then you have to pay 133 as the. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Learn More About Income Taxes.

Unlike long-term capital gains short term capital gains are taxed at your regular marginal tax rate. This calculator only calculates capital gains for the sale of Canadian assets and assets in countries with whom Canada does not have a tax treaty. Added 19 Corporation tax rate changes from 201718.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Ohio has 1424 special sales tax jurisdictions with local sales taxes in addition to the. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2022.

Capital gains taxes on assets held for a year or less correspond to ordinary income tax. Calculator frequently asked questions can be found under most calculators. Province Tax Payable After-Tax Income Average Tax Rate Marginal Tax Rate Marginal Rate on Capital Gains Marginal Rate on Eligible Dividends Marginal Rate on Ineligible Dividends British Columbia BC.

Marginal rate relief has been removed. To understand how marginal rates work consider the bottom tax rate of 10. Please enter your income.

Perhaps the most important thing to know about the progressive tax system is that all of your income may not be taxed at the same rate. Income tax brackets for the 2021 tax year tax returns filed in 2022 are as. Social Security Payroll.

Use this calculator to help estimate your income tax rate tax bracket and marginal tax rate for the current year. Weighing the tax landscape against your financial picture could help you stretch your dollars further. In partnership with your tax professional an Ameriprise advisor can help minimize the.

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2022. 2022 free Nova Scotia income tax calculator to quickly estimate your provincial taxes. Ontario land transfer tax calculation.

In this formula any gain made is included in formula. For the 2016-17 financial year the marginal tax rate for incomes over 180000 includes the Temporary Budget Repair Levy of 2. Your household income location filing status and number of personal exemptions.

The calculator reflects known rates as of June 15 2021. Income Tax Calculator. This free tax calculator is supported by Google Consumer Surveys.

Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing. Groceries and prescription drugs are exempt from the Ohio sales tax. This will help you calculate your tax liability for unexpected income retirement planning or investment income.

Marginal tax rate calculator. Let us see an example to understand it. Tax tables show the total amount of tax you owe but how does the IRS come up with the numbers in those tables.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. If you have 10150 in taxable income the first 9950 is subject to the 10 rate and the remaining 200 is subject to the tax rate of the next bracket 12. 2022 Income Tax Calculator Nova Scotia.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Certain businesses located within Urban Enterprise Zones including Salem County are required to only collect a reduced sales tax of 50 the state sales tax rate. That means that the highest rate applies only to money you earn above and beyond the upper limit of the lower rate.

If you are a single filer and have 40000 in taxable income in 2021 you paid 10 on the first 9950 12 on the next 30575. Counties and cities can charge an additional local sales tax of up to 225 for a maximum possible combined sales tax of 8. Income Taxes By State.

Corporation Tax Calculator 20222023. This increases the inclusion rate to 100. Get 247 customer support help when you place a homework help service order with us.

The Ohio state sales tax rate is 575 and the average OH sales tax after local surtaxes is 71. Kansas collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

Like the Federal Income Tax Kansas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Refer to these for more detailed information about how a specific calculator works. An investor purchase 100 shares at a price of 15 per share and he received a dividend of 2 per share every year and after 5 years sell them at a price of 45.

How Marginal Tax Brackets Work. Your household income location filing status and number of personal exemptions. In most cases your employer will deduct the income tax from your wages and pay it to the ATO.

2020-2021 pre-budget reflects the tax rates prior to those announced in the Budget in October 2020. Updated for the 2013 tax year main rate reduction to 23 - Other changes to be confirmed. 2022 free Alberta income tax calculator to quickly estimate your provincial taxes.

Updated for the 2022-2023 tax year. Kansas maximum marginal income tax rate is the 1st highest in the United States ranking directly. Items such as groceries household paper products medicine and clothes are exempt from all sales taxes.

It does not calculate the. 10 states with the highest personal income tax rates. Find out your marginal tax rate.

An example of how marginal tax rates work. The Federal Income Tax. Answer a simple question or complete an alternate activity to.

For single filers all income between 0 and 9950 is subject to a 10 tax rate. A comparison of 2020 tax rates compiled by the Tax Foundation ranks California as the top taxer with a 123 rate unless you make more than 1 million. The Pennsylvania sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the PA state sales tax.

Jun 03 2022 - 110316 AM. 2022 Marginal Tax Rates Calculator. Income Tax Surcharge Rate Marginal Relief Latest Rates Updated on.

Rate of Return Formula Example 3. An easy way to think of marginal tax rate is to define it as the rate you would pay on a fictional additional dollar of income. Interest and dividends often received through investments such as money market accounts and mutual funds.

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

Tax Shield Formula How To Calculate Tax Shield With Example

Levered And Unlevered Beta Formula And Calculator

Dupont Analysis Formula Breakdown And Calculator

Marginal And Average Tax Rates Example Calculation Youtube

Margin Calculator

Income Tax Formula Excel University

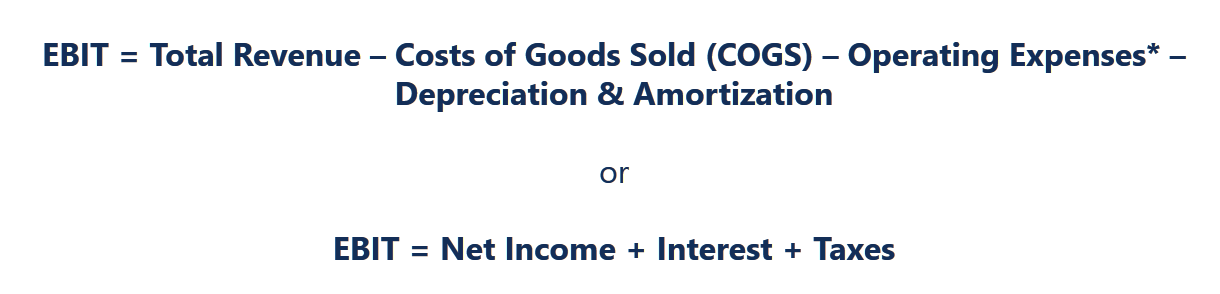

Ebit Earnings Before Interest Taxes What You Need To Know

Marginal Tax Rate Formula Definition Investinganswers

Effective Tax Rate Definition

Canada Child Benefit The Hidden Tax Rate Planeasy

Excel Formula Income Tax Bracket Calculation Exceljet

Net Profit Margin Formula And Ratio Calculator

Cost Of Debt Kd Formula And Calculator

Taxation Calculations Ppt Video Online Download

How And Why To Calculate Your Marginal Tax Rate Deliberatechange Ca

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition